Who we are

- Wimmer Financial is an international boutique investment bank focused on project debt and equity development financing of real estate (residential, commercial, infrastructure), natural resources (mining, oil & gas, alternative energy,) infrastructure, industrials, aviation, shipping and cash flow based financing.

- Our capabilities encompasses listed equity, senior debt, mezz debt, private equity, project finance, alternative debt financing and M&A.

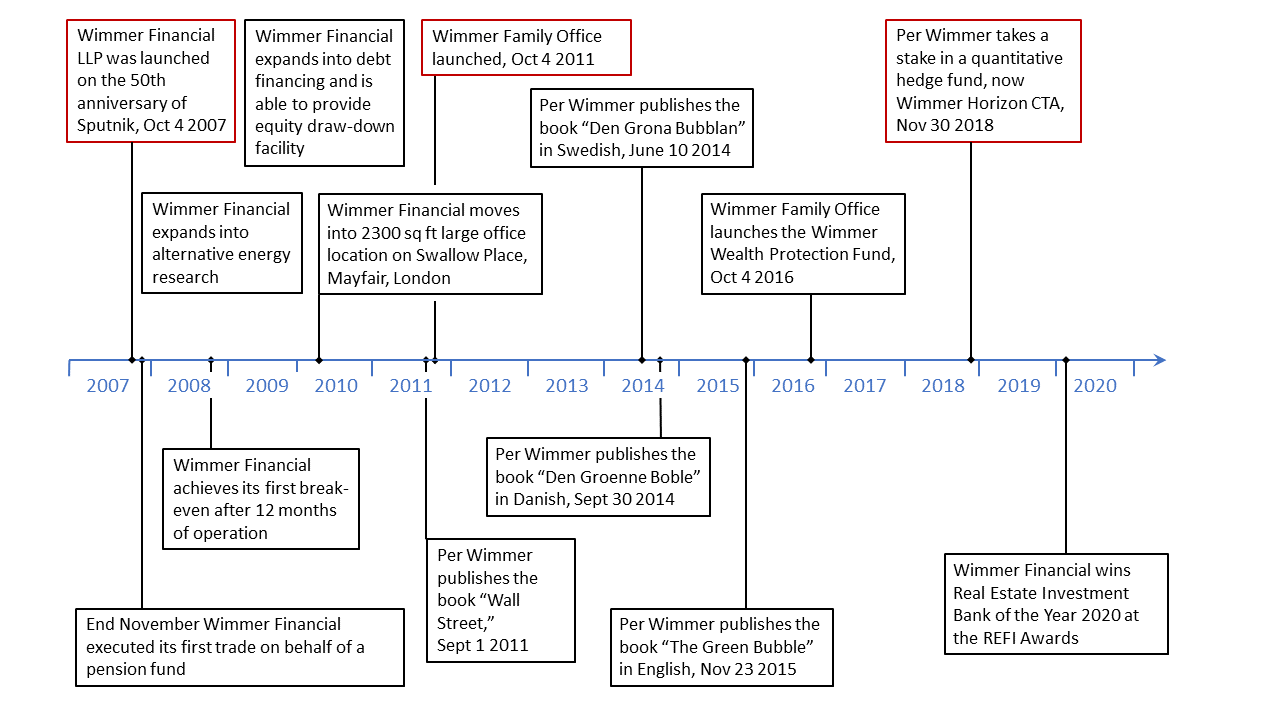

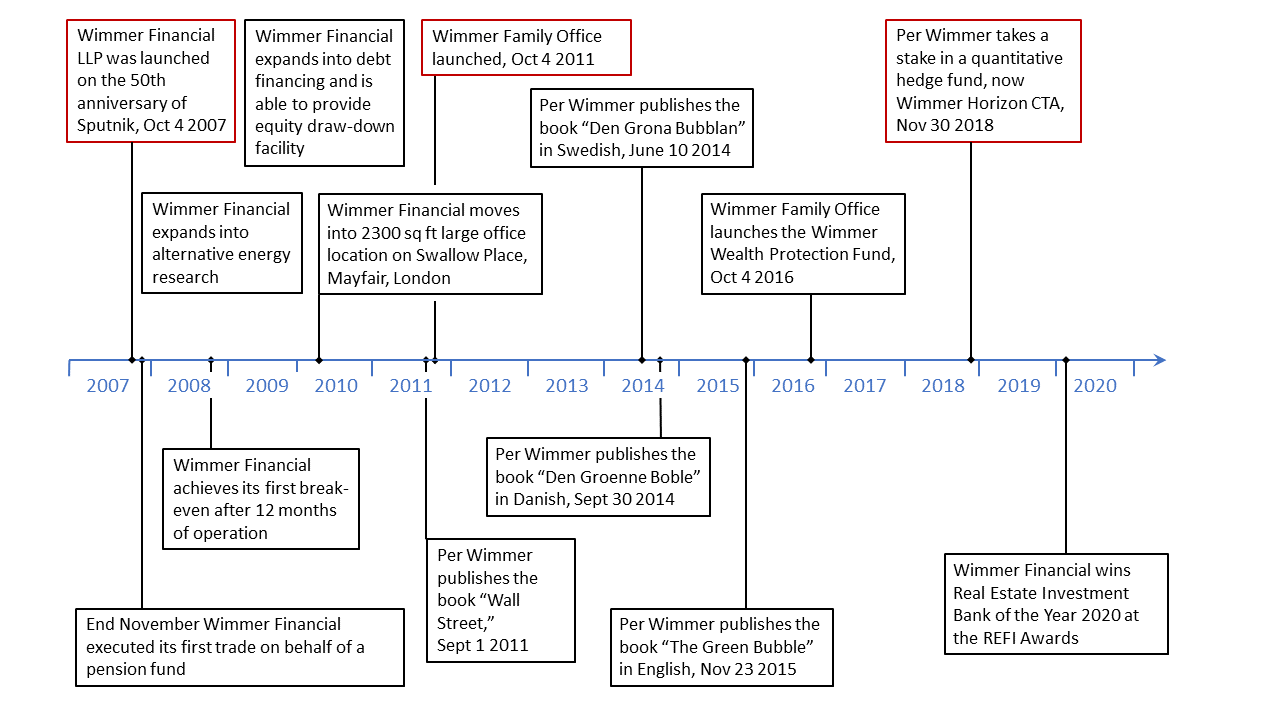

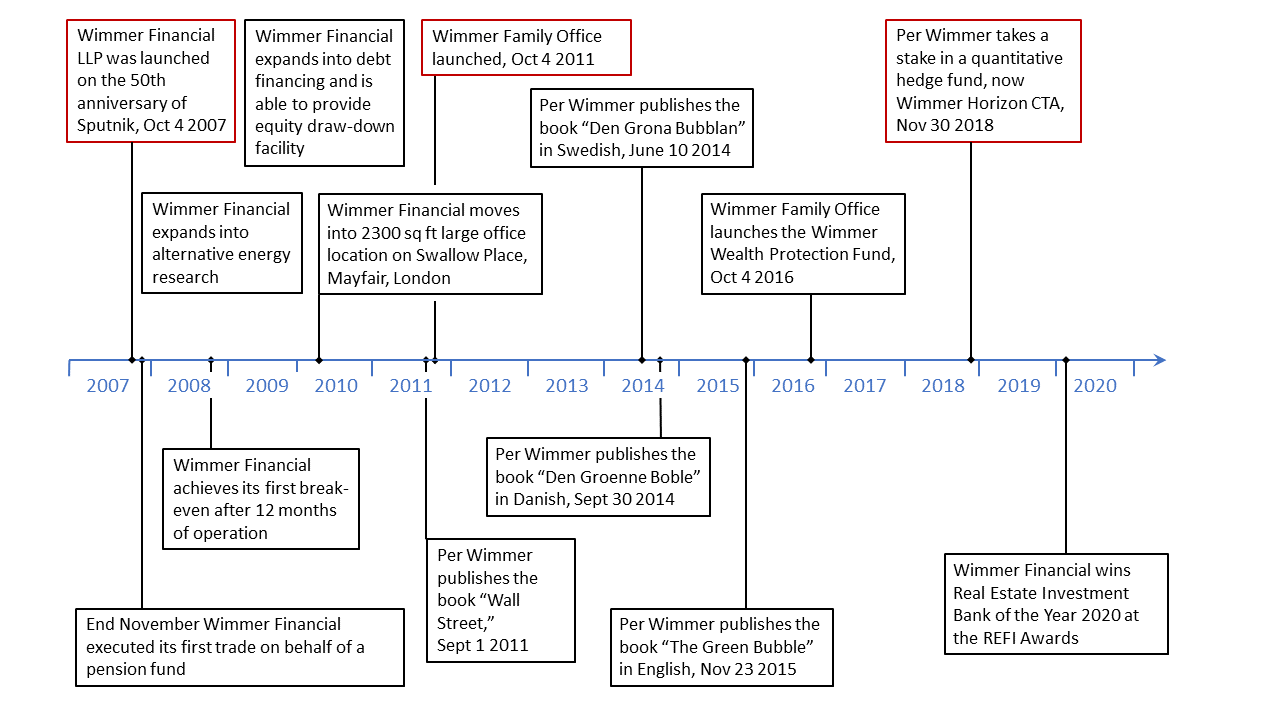

- Established on Oct 4 2007, the firm brings together a team of senior banking professionals with diversified geographic, product and transaction backgrounds. This multi-disciplinary approach enables Wimmer Financial to have a breadth of professional experience characteristic of much larger franchises.

- Our team prides itself on its integrity and agility and its client-led, partnering approach. In its range of experience, the team is particularly suited to advising growth companies seeking the next stage of development.

- Through its association with its sister company, Wimmer Family Office, the firm benefits from extensive connections into the world of family offices and private investment capital. These, together with its mainstream institutional investor base, mean that Wimmer Financial can provide broad access to global capital.

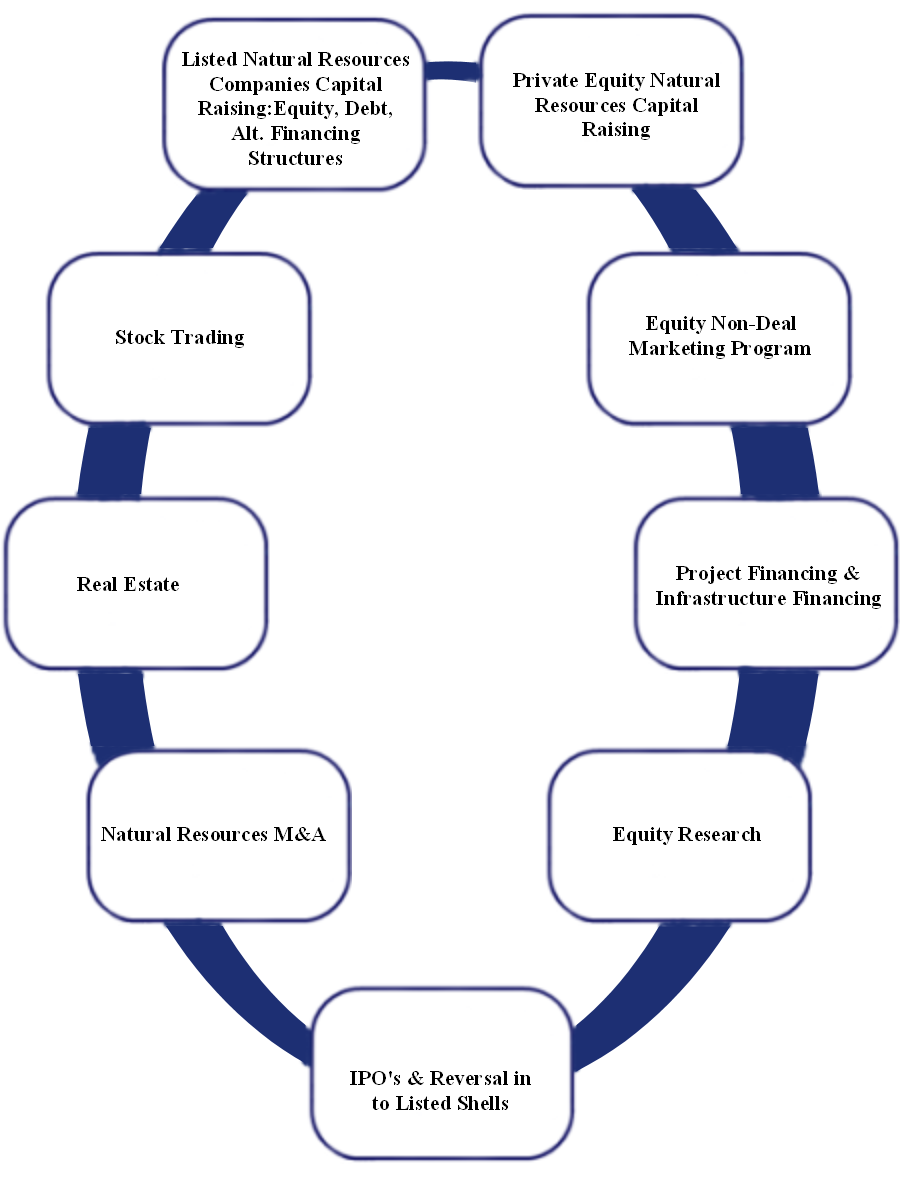

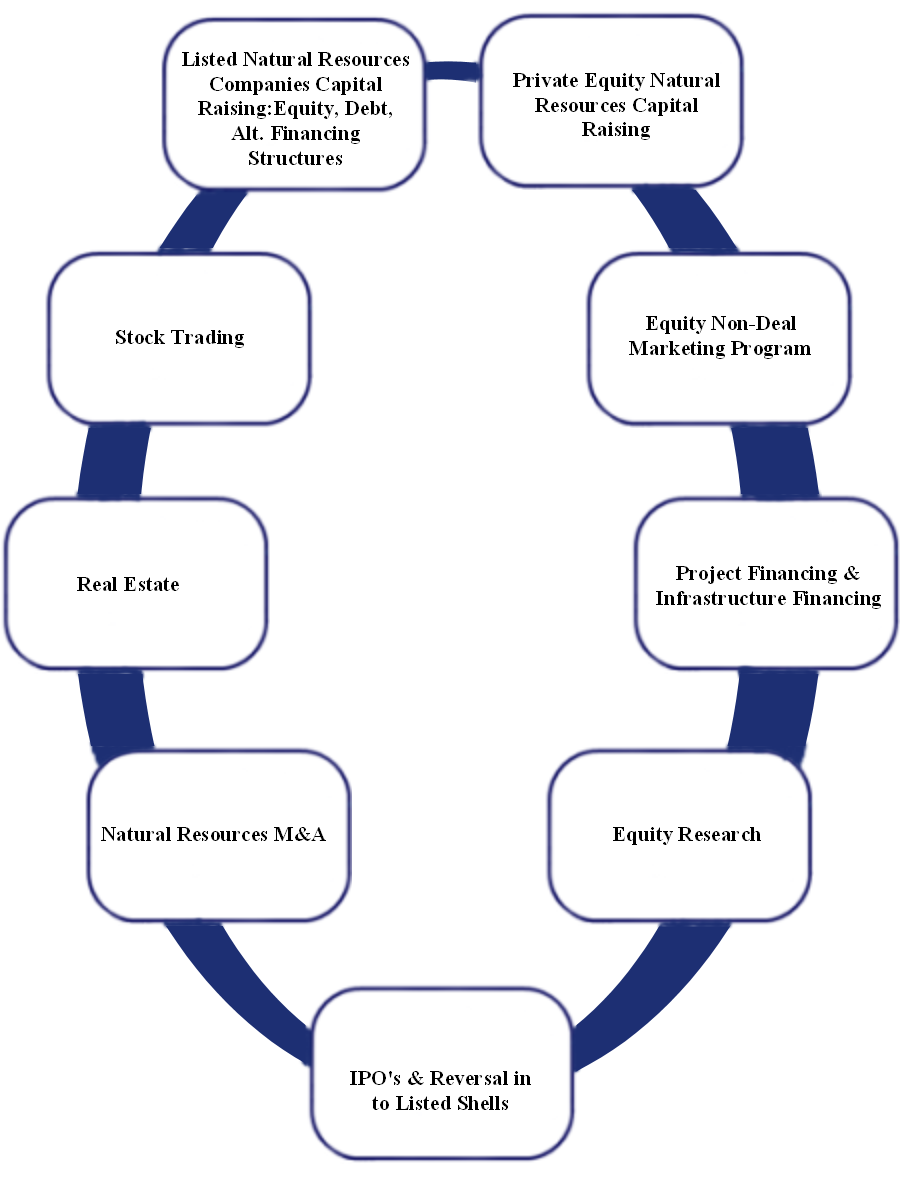

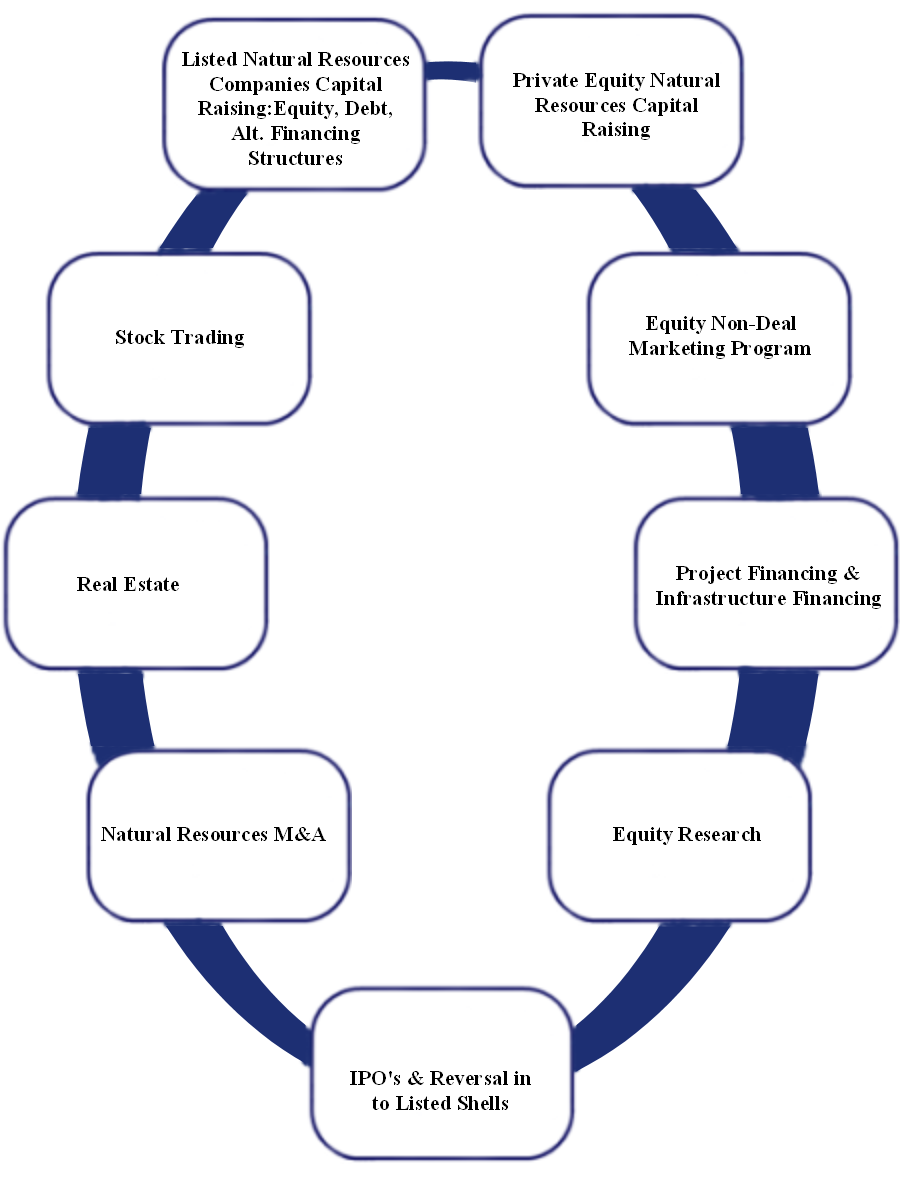

What we do

- Wimmer Financial specialises in large scale project debt and equity financing junior and mid-tier growth companies.

- The companies are primarily in the global real estate development space (residential, commercial, infrastructure), natural resources sector mining, oil & gas and alternative energy), industrial, aviation, shipping and cash flow based financing. They are most commonly private or listed on the ASX, the TSX or AIM.

- Our financing capabilities range from securing equity capital in private and public markets all the way through to arranging senior, mezz and alternative debt. The spectrum of our expertise in between encompasses more innovative forms of financing such as structured finance, high yield, royalty financing, stream financing, commodity prepayment/offtake structures, supplier finance and EXIM structured loans.

- Wimmer Financial has a wide range of access to both institutional, family offices, private investment offices and private high net worth investors.

- Wimmer Financial also arrange Non-Deal Roadshows and related marketing initiatives where there is no intended capital raise. We tailor these to the specific requirements of the corporate.

|

Sources of Finance:

- Hedge Funds

- Family offices and private investment offices

- High net worth investors and networks

- Wealth Managers

- Long-only institutional investors and funds

- Specialist natural resource investors

- Focused real estate equity and debt investors

- Alternative debt, mezz and non-equity capital providers

- Global renewable energy and infrastructure funds

- Global banks and other alternative lenders

- Regional banks

- Development agencies

- Export credit agencies

|

|

Our Typical Corporates:

- Large scale experienced real estate development companies.

- Experienced acquisition management team in need of large scale acquisition finance.

- Mid-tier natural resource companies at the BFS/DFS stage seeking project development financing.

- Strong cash flowing companies seeking large scale growth financing.

|

Overview of the Wimmer Group of Companies

|

|

|

|

|

|

Founded Oct 4 2007

www.WimmerFinancial.com

- Corporate Finance

- Project Debt and Equity Finance

- Capital Raising

- M & A

- IPO's

- Private Equity

- Sectors: Real Estate, Natural Resources, Industrials, Shipping, Aviation, Cash Flowing Companies

|

|

Founded Oct 4 2011

www.WFO.am

- The Wimmer Wealth Protection Strategy – balanced portfolio fund allocation investments across asset classes with CTA overlay targeting a low to medium risk profile with high single digit returns.

- Global large scale real estate development debt and equity financing from $ 150 M and up.

- Project debt and equity development financing for natural resource companies at the BFS/DFS stage or equivalent (mining, oil & gas, green energy.)

- Other opportunistic ad hoc investments, preferably with synergies to existing portfolio.

|

|

|

|

Founded Oct 4 2000

www.WimmerSpace.com

- A trip to space as an astronaut.

- Space training (weightlessness/Zero-G, fighter jets, centrifuge training.)

- The World’s First Everest Tandem Sky Dive.

- Adventures on Earth (travelled to 80 countries, lived with the Amazon Indians, skiing at 5000 meters, diving with sharks in Fiji without cage, Titanic dive attempt 2012 and 2019, flying jet packs, etc.)

- Charity work with a focus on inspiring children to live out their dreams and sharing the Wimmer Seven Fundamental Values.

- TV documentaries and programs about charity, space, finance and Per Wimmer’s story.

- Investments and advice in space-related businesses.

- Publishing: Writing and publishing books, including a book in French about the European Union, a book about the bubbles of financial markets ‘Wall Street,’ a book about green energy ‘The Green Bubble,’ and Per’s autobiography and other book contributions (see under “Shop”)

- Motivational speaking for schools and corporates

|

|

|